There’s lots of great advice in the video below. Your credit matters, and not just when you’re buying a home. Your credit score can also affect Insurance rates, job opportunities, and major purchases like a car or furniture.

If you are thinking of buying a home there are a couple other points relating to your credit that I urge you to keep in mind.

- For at least 2-3 months before you apply for a mortgage, don’t move your money from account to account.

- Don’t switch jobs shortly before or during the mortgage process if you can help it, and Don’t, DON’T quit your job.

- And one other thing to be aware of during the mortgage process, any major purchase such as a car or furniture, can make your debt to income ratios unacceptable AND could delay your closing.

Just a few tips for a time when it’s very important to be aware of your credit. There are a few more tips for Home Buyers and Home Sellers below.

Additional Resources for Home Buyers

- A Heads Up for Home Buyers

- Being Prepared

- For First-Time Buyers

- How Can I Help You?

- Do You Need a Buyer Agent

- Getting Pre-Approved

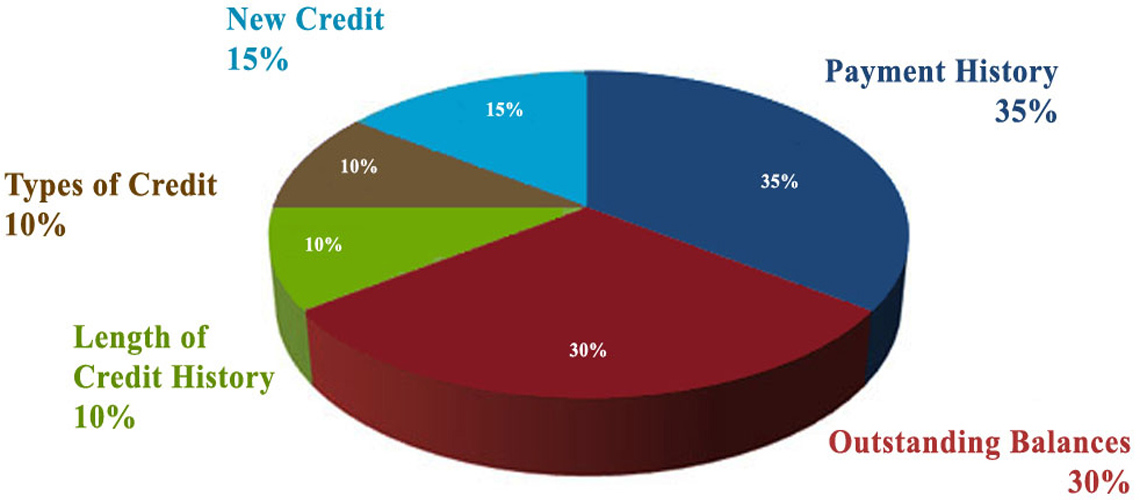

- Understanding Your Credit Score

- How Much Should I Offer?

- Offers and Purchase Agreements

- Who Pays for What?