Can you improve your own credit score? The video below offers some advice if you choose to work with a credit counselor and some warnings, but you can actually repair your credit yourself in a few straightforward steps.

- Check your credit report on annualcreditreport.com. This is the only site authorized by federal law to provide a free credit report every 12 months. Be aware, this is not the same as your credit score but this is where you should start, it will alert you to any possible blemishes. Note: be wary of other websites offering free credit reports, they are often scams, there may be hidden charges or obligations.

- Check your report for errors: these might be accounts that don’t belong to you, ones that were closed or paid off but still reporting as active. There may also be mistakes in your legitimate accounts, review them carefully. Note: it costs nothing to dispute errors in your credit report. More on disputes below.

- Take note of late payments. Late payments are a major contributor to poor credit. In order to boost your credit score it is critical to begin and continue paying all debt payments on time. Do not rely on any grace periods you may have been promised.

- Pay down debt. If and when you are able to pay more than minimum or required payments, do so. The amount of debt you owe compared to the amount of the original loan or credit card limit is a big factor in calculating your credit score.

- Avoid adding new debt. An improving credit score can be instantly dinged by incurring new debt. When you’re working on improving your credit you’ll need to make difficult choices between your wants and your score.

- Take stock of your income and create a reasonable budget. moneyunder30.com has some great suggestions and a step-by-step process for sensible budgeting.

- Dispute errors on your credit report. There is no charge to dispute errors but do be judicious about this. Credit reporting companies do not look kindly on bickering over accurate information. If your poor credit is due to your own negligence, own it and move on. Legitimate mistakes must be disputed in writing with each individual credit bureau, including as much supporting documentation as you can provide. Check each credit bureau’s web site for their process and submission guidelines.

- And one additional tip for keeping your credit out of the hands of criminals, who could very quickly destroy all of your credit repair efforts, the FTC (Federal Trade Commission) suggest freezing or locking your credit. Details are available on the consumer.ftc.gov website.

Video: Improving Your Credit Score, How and Why

Video Transcript: Improving Your Credit Score, How and Why

Welcome to Today’s Home Update, I’m Cheyenne.

Do you have poor or little credit? According to the FDIC, consider consulting with a reputable credit counseling service to help develop a customized plan which may include helping you decide how to prioritize your spending choices.

Counseling services are available to help consumers budget money, pay bills, and develop a plan to improve their credit history. However, be cautious of services that advise you to stop making payments to your creditors, or to make your payments to the counselors instead. These programs can be costly and may result in your credit score becoming even worse. And they could be scams.

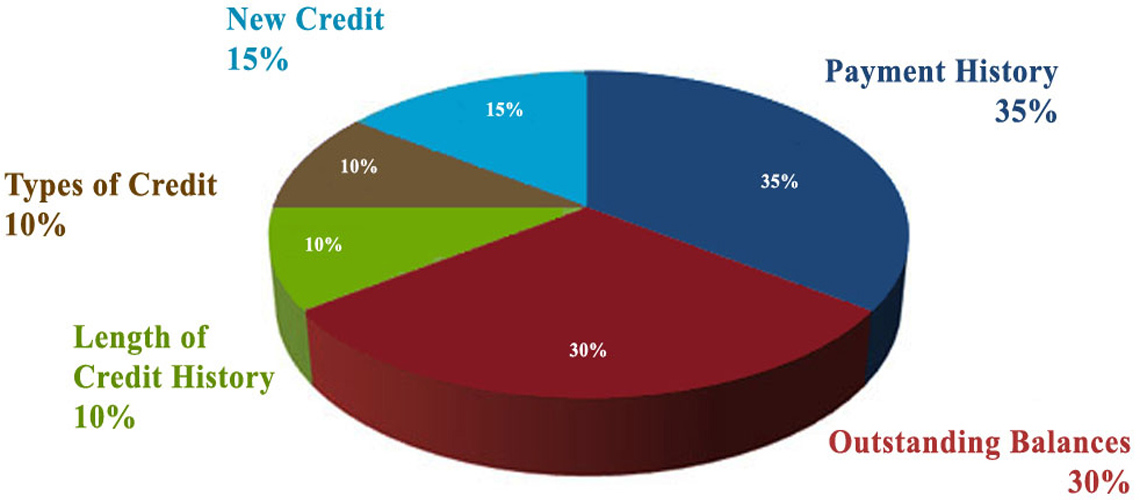

Understand what information is most likely to influence your credit scores. In general, the most significant factor affecting your score is whether you repay your debts on time, and how much you currently owe on each account compared to its original loan amount or credit limit.

Additional factors include how long you’ve had your current loans and credit cards, and types of credit accounts you have.

Rebuilding your credit score may take time but it is possible and worth it in the long run.

Thanks for watching Today’s Home Update, see you next time.

Author’s Note: Your credit score can impair more than your ability to buy a home. If you are able to get a mortgage, a less than stellar credit score can influence the mortgage interest rate and terms you are offered. The lowest home loan rates are reserved for those with strong credit. Insurance premiums, security clearances, apartment leases, cell phone contracts, employment, even gym memberships can be affected.

For more information, Call or Text: 602-999-0952

eMail: golfarizona@cox.net

Bill Salvatore / Arizona Elite Properties

Residential Sales, Marketing, and Property Management

There are still down payment assistance programs available in Maricopa and Pinal Counties. These are grants, NO repayment necessary. Call us for details: 602-999-0952

We also have options to help with your closing costs. See the links below or feel free to call or email for additional information: 602-999-0952 / golfarizona@cox.net

Learn more about the Arizona Heroes Home Advantage cash-back program. NO cost, NO pre-registration, NO obligation.

— — —

Other Valuable Resources

AZVHV – Arizona Veterans Helping Veterans

Ever wonder what Closing Costs you’ll be responsible for when you buy or sell a home? Check out our infographic and article:

Who Pays for What?

— — —

What is standard and legal procedure in a Real Estate transaction?

Home Purchase Offers and Agreements 101

Additional Helpful Information for Home Buyers

Getting Pre-Approved for a Mortgage

— — — — — — — —

Help for Home Sellers

Order a Free Market Analysis Online